Picture this: You’re enjoying a quiet afternoon when the phone rings. The caller, sounding distressed, claims to be your grandson. He’s in trouble—begging for help. Or maybe it’s an email from your bank, urgently warning that your account is locked. Click the link, they say. Fix the problem, they insist.

Something feels off, but they sound so convincing. And before you know it, you’re caught in an online scam.

It’s happening every day. Seniors across Indiana are being targeted by fraudsters who prey on trust, kindness, and the belief that people are who they say they are. These scams aren’t just frustrating—they can cost people thousands, even their life savings.

But here’s the good news: spotting the warning signs is easier than you think. Scammers may be clever, but they’re also predictable.

1. The “Grandparent” Scam

Picture this: The phone rings, and the voice on the other end is frantic. “Grandma, it’s me! I’m in trouble—I need money!” The caller sounds just enough like your grandchild to make you panic. They say they’ve been in an accident, arrested, or even kidnapped. They need you to wire money immediately, and they beg you not to tell anyone.

It’s a cruel trick. Scammers use social media to learn about families, sometimes even using AI-generated voices to mimic a real person.

How to stay safe:

- Hang up and call your grandchild (or another family member) directly.

- Never send money or gift cards to someone under pressure.

- Ask a question only your real grandchild would know the answer to.

2. Fake Tech Support Calls

Out of nowhere, a pop-up appears on your screen warning that your computer is infected with a virus. A number appears, urging you to call for “immediate support.” Maybe you get an unexpected call from “Microsoft” or “Apple” saying they’ve detected an issue on your device.

It’s all nonsense. The goal? To scare you into paying for fake repairs or trick you into giving remote access to your computer.

Protect yourself:

- Never call the number on a pop-up—it’s fake.

- Legitimate tech companies never call out of the blue.

- If you’re worried about a computer issue, take it to a local, trusted repair shop.

3. Romance Scams

Loneliness is a powerful thing, and scammers know it. They create fake profiles on dating sites, social media, or even church forums. At first, they shower you with attention, telling you everything you want to hear. But soon, a problem comes up—medical bills, a business deal gone wrong, a sick relative. They can’t access their funds, and they just need a little help.

They promise to pay you back. They never do.

Red flags:

- They avoid video calls or in-person meetings.

- They fall in love fast—too fast.

- They always have an excuse for why they need money.

4. Medicare and Health Insurance Scams

A call comes in from someone claiming to be with Medicare. They need your Social Security number, banking info, or some other personal detail to “verify” your account. Sometimes, scammers offer free medical equipment—braces, wheelchairs, or hearing aids—if you provide your Medicare number.

Sounds helpful, but it’s all a trick. Once they get your information, they can commit fraud under your name.

Stay ahead of them:

- Medicare will never call asking for personal details.

- If something sounds suspicious, hang up and call Medicare directly.

- Don’t give out insurance information unless you’re at your doctor’s office.

5. Sweepstakes & Lottery Scams

“You’ve won! But before we send your prize, we need a small fee to cover taxes or processing.”

Big red flag. If you really won something, you wouldn’t have to pay for it. Scammers count on excitement overriding common sense. They’ll ask for bank transfers, gift cards, or even your personal information to “verify” your winnings.

How to avoid getting caught:

- If you didn’t enter, you didn’t win.

- No legitimate prize requires payment.

- Don’t share personal information with a stranger.

6. Social Security Scams

A stern voice on the phone warns that your Social Security benefits are at risk. Maybe they say your number has been suspended or that there’s fraudulent activity on your account. They’ll demand immediate payment to fix it.

It’s all fake. Social Security will never call to threaten you.

What to do:

- Hang up and ignore the call.

- Never share your Social Security number with anyone over the phone.

- If you’re unsure, contact the Social Security Administration directly.

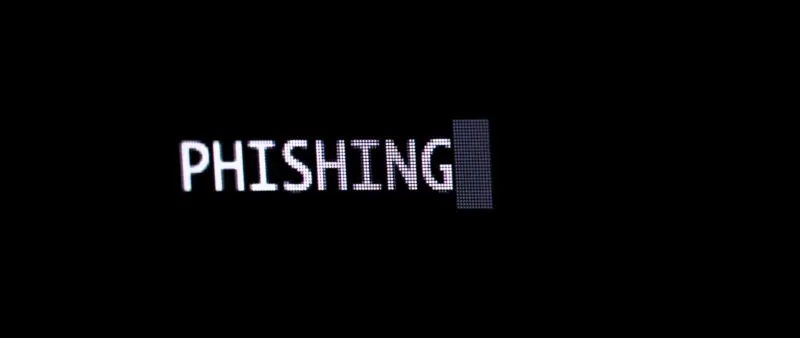

7. Phishing Emails & Fake Websites

You get an email that looks like it’s from your bank, Amazon, or even your doctor’s office. It warns that your account is locked, and you need to click a link to fix it. That link leads to a fake website designed to steal your login details.

Spot the tricks:

- Look for typos, odd formatting, or generic greetings (“Dear Customer” instead of your name).

- Hover over links before clicking—if the address looks weird, don’t touch it.

- Contact companies directly using official phone numbers, not links from emails.

One easy way to protect yourself? Use a veepn.com when browsing. A VPN adds an extra layer of security, making it harder for scammers to track your online activity or steal your personal data. Plus, it helps block some of those shady pop-ups that trick people into clicking fake alerts.

8. Fake Charities

Scammers love using tragedy to their advantage. After natural disasters, fires, or even local tragedies, fraudulent charities pop up asking for donations. They might call, email, or even knock on your door.

Protect your generosity:

- Donate only to known charities.

- Look up organizations on Charity Navigator before giving.

- If someone pressures you to give immediately, step away.

9. Online Shopping & Facebook Marketplace Scams

You see a deal too good to pass up—a designer handbag, a fancy gadget, or even a vacation package at an unbeatable price. But after you pay, the item never arrives.

Scammers use fake online stores, sketchy ads, and even hacked social media accounts to trick people into buying things that don’t exist.

Avoid the trap:

- Only shop on trusted sites.

- Check reviews and refund policies.

- Use secure payment methods—never wire money or pay with gift cards.

10. Investment & Cryptocurrency Scams

A “financial expert” reaches out, promising a surefire way to double your money. Maybe it’s a cryptocurrency scheme or a too-good-to-be-true stock tip. They use high-pressure tactics to make you feel like you’ll miss out if you don’t act fast.

More often than not, it’s a scam. By the time victims realize, the money is long gone.

Play it safe:

- If an investment sounds too good, it probably is.

- Never invest in something you don’t fully understand.

- Talk to a trusted financial advisor before making any big decisions.

Final Thoughts

Scammers are getting more creative, but that doesn’t mean we have to live in fear. A little skepticism goes a long way. If something feels off, trust your gut.

And hey—spread the word. If you’ve spotted one of these scams, tell your friends and family. We’re stronger together, and the more people know about these tricks, the harder it becomes for scammers to succeed.

Have you or someone you know encountered a scam like these?

Related Posts:

- Online Tool Empowers Hoosier Communities to Combat…

- Is Indiana a Republican or Democratic State? True…

- The Mastodon Could Become the State Fossil, But Is…

- Why Indiana’s Clean Community Program Matters for…

- How iGaming in Indiana Could Reduce Casino-Related Pollution

- Indiana’s Youth Take the Lead in Climate Change Action