A surprise multi-billion-dollar agreement by U.S. Senate Democrats has led to a bill which, in its current form, could have important consequences for Hoosier health, the environment and the state’s economy.

The Inflation Reduction Act of 2022, a broad bill negotiated by Senate Majority Leader Chuck Schumer and chair of the Senate Energy and Natural Resources Committee Sen. Joe Manchin, includes billions of dollars in major energy and climate provisions that extends the life of fossil fuels but provides funding to aid in the transition to renewable energy sources.

The bill still needs to survive both houses of Congress in order to become law. Indiana’s Republican Congressional delegation will most likely vote against the bill.

If passed, the bill could help the nation meet a major emissions reductions goal set by President Joe Biden that calls for a 50% reduction in national greenhouse gas emissions by 2030.

“This bill would be the most significant legislation in history to tackle the climate crisis and improve our energy security right away. It gives us a tool to meet the climate goals that we've agreed to by cutting emissions and accelerating clean energy, a huge step forward,” Biden said.

Manchin, a main author of the bill who had almost singlehandedly defeated a previous attempt, touted the bill’s energy and manufacturing provisions on Sunday morning talk shows.

“We're basically investing in reliable energy, making sure that we use our fossil fuels as clean and cleaner than anyplace else in the world,” Manchin told ABC. “But we basically aggressively produce more energy to reduce the prices of gasoline, and energy costs at your house and everywhere else. And, basically, we've invested in new technologies to bring more manufacturing back, such as batteries. We're going to start making batteries in America. We're starting extracting rare earth minerals, producing it, processing it, making it here.”

The bill faces opposition from Republicans in the Senate, including from both of Indiana’s senators. Sen. Todd Young called the legislation “anti-Indiana” and said it would “slam” Indiana’s manufacturers. Sen. Mike Braun told Fox Business the bill would “kill America’s energy independence.”

Senate Democrats hope to overcome that opposition by passing the bill through the Senate reconciliation process. The process cannot be filibustered and requires only a simple majority, which would require the votes of all 50 Senate Democrats and a tie-breaking vote from Vice President Kamala Harris, to move the bill forward.

Many environmental groups agree to parts of the bill, but oppose what they call “giveaways” to the fossil fuel industry, like tax cuts and new federal oil and gas leases.

More than 200 environmental and conservation groups oppose a related deal between Manchin and Democratic leaders. That deal would clinch Manchin’s support for the Inflation Reduction Act by passing legislation that would limit National Environmental Policy Act environmental reviews of “major” projects to two years, a Trump administration timeframe that was undone by the Biden administration. The proposed deal would also ease the approval of the 300-mile-long Mountain Valley Pipeline, which would transport Appalachian shale gas from West Virginia to Virginia.

“Without a robust NEPA it will be virtually impossible to reach net-zero emissions by 2050 or achieve President Biden’s Justice40 Initiative, a government-wide pledge to commit 40 percent of federal investments in clean energy and climate infrastructure to disadvantaged communities. For low-income and minority communities, which are often disproportionately impacted by health problems associated with poorly planned federal projects, NEPA isn’t just an environmental protection statute. It’s a critical tool for civic engagement and social justice we cannot afford to lose,” the groups said in a letter to U.S. Senators.

SOME MAJOR CLIMATE PROVISIONS IN THE BILL

TAX CREDITS FOR CARBON-FREE POWER

The bill gives billions of dollars in tax credits for at least a decade to companies that build emissions-free electricity systems, like wind turbines, solar panels, battery storage, geothermal plants or advanced nuclear reactors.

The bill also provides tax credits to companies that undertake advanced energy projects or manufacture components for those projects, including solar panels, wind turbines, batteries and critical minerals.

The legislation would also allocate about $30 billion in grants and loans for states and utility companies to invest in renewable energy systems and decarbonization technologies, including struggling and nascent carbon-free energy sources like solar energy and small nuclear reactors.

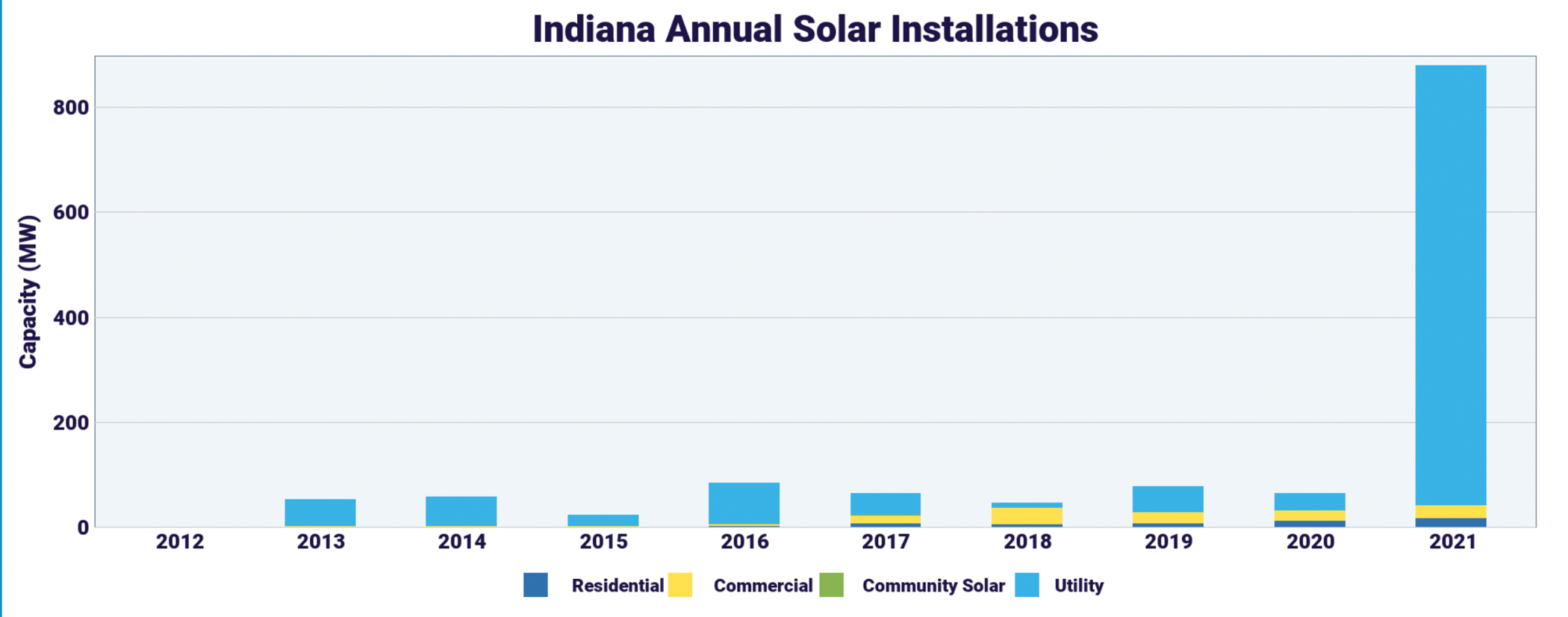

The tax credits could give a huge boost to the solar industry, which has experienced a significant slump in installations. The industry saw a 59% decrease in community solar system installations and a 64% decrease in utility-scale solar installations.

Indiana ranked 6th in the nation for solar installations in 2021, but has since dropped to 19th according to the Solar Energy Industries Association.

Some of the decline is due to the successful campaign by utility companies to eliminate net metering, which allowed residential solar system owners to sell unused electricity back to power companies at higher rates than its successor, the excess distributed generation tariff.

A federal investigation into alleged tariff circumvention in southeast Asia caused a major disruption in the solar energy supply chain, causing U.S. companies to put a hold on many new solar installations. The Biden administration suspended tariffs for solar cells and modules for two years, but only after companies paused plans for solar installations.

The disruption caused a delay in the retirement of at least two coal-fired generation units in Indiana. The Northern Indiana Public Service Co. announced the planned 2023 retirement of two coal units would be delayed up to 18 months due to the federal solar tariff investigation.

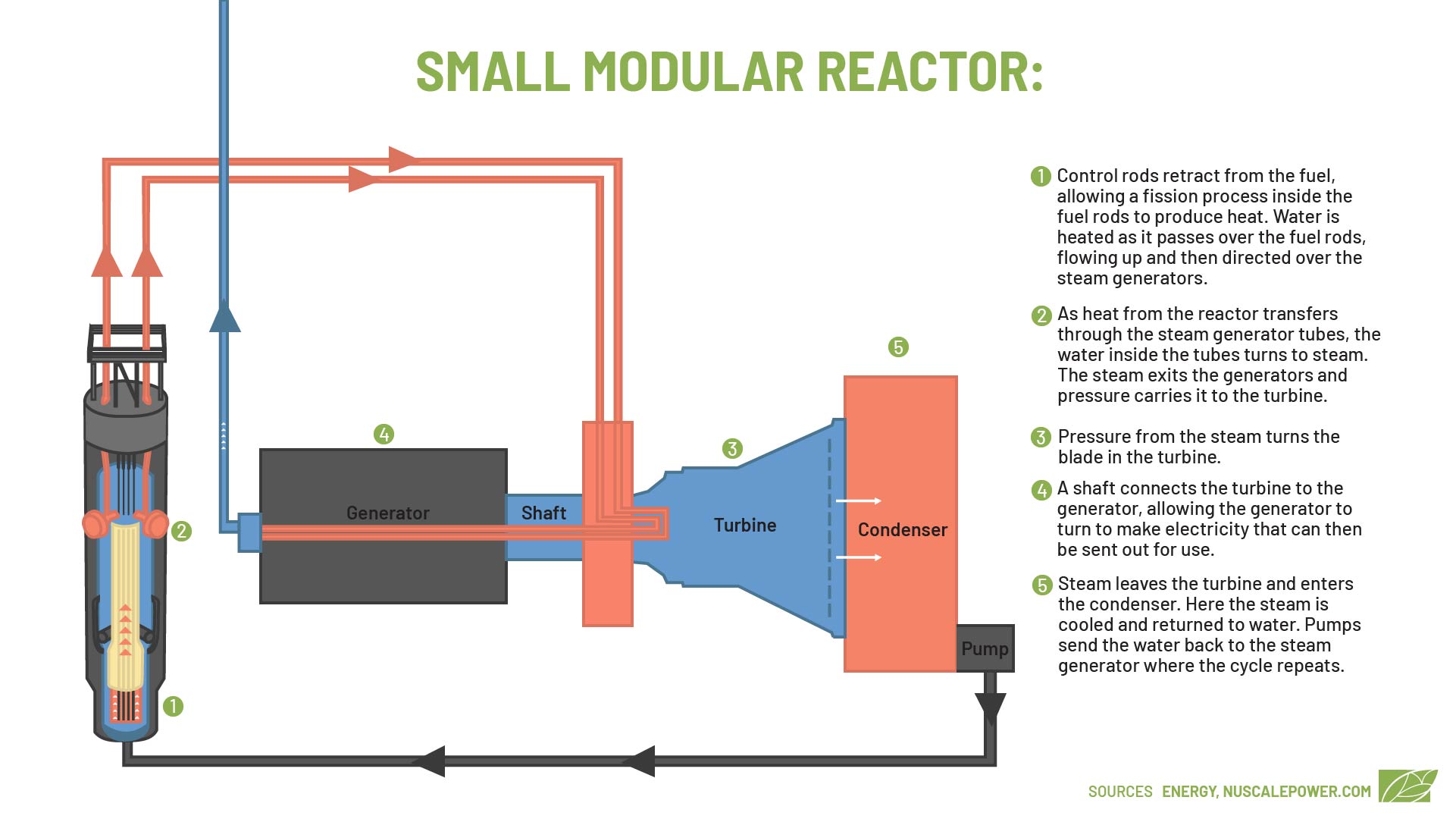

The bill would also help establish small modular nuclear reactors as a carbon-free energy alternative in Indiana.

The Indiana General Assembly passed a law this year allowing companies to build 350-megawatt small modular nuclear reactors in the state as long as the company trying to build the reactor “provided evidence of a plan to apply” for federal permits required to operate a nuclear reactor.

Lawmakers said the reactors could be built on the site of retired coal-fired power plants, and nuclear waste created by the reactors would most likely be stored on the plant’s grounds.

Only one SMR reactor project is scheduled for construction, the six-SMR Carbon Free Power Project at the DOE’s Idaho National Laboratory. The project has experienced significant cost overruns, delays and project modifications since the project was approved by the U.S. Nuclear Regulatory Commission.

Environmental and consumer advocacy groups have argued that utility companies would pass on the price tag of costly SMR projects without ever providing electricity. The Indiana SMR law allows utilities to recover costs of the SMR project through rate increases for utility customers.

The NRC is set to certify at least one SMR design for use in the U.S.

Several utility companies, including NIPSCO and AES Indiana, have said SMRs could be a part of their future long-term plans. Duke Energy Corp. partnered with Purdue University to study the feasibility of using an SMR as a campus power source.

The bill also imposes a gas and oil production “waste emissions charge” of $900 per metric ton of methane emissions for methane leaks that exceed a federally set level. The charge would increase to $1,500 per metric ton in 2026.

EXPANSION OF CARBON CAPTURE TAX CREDIT

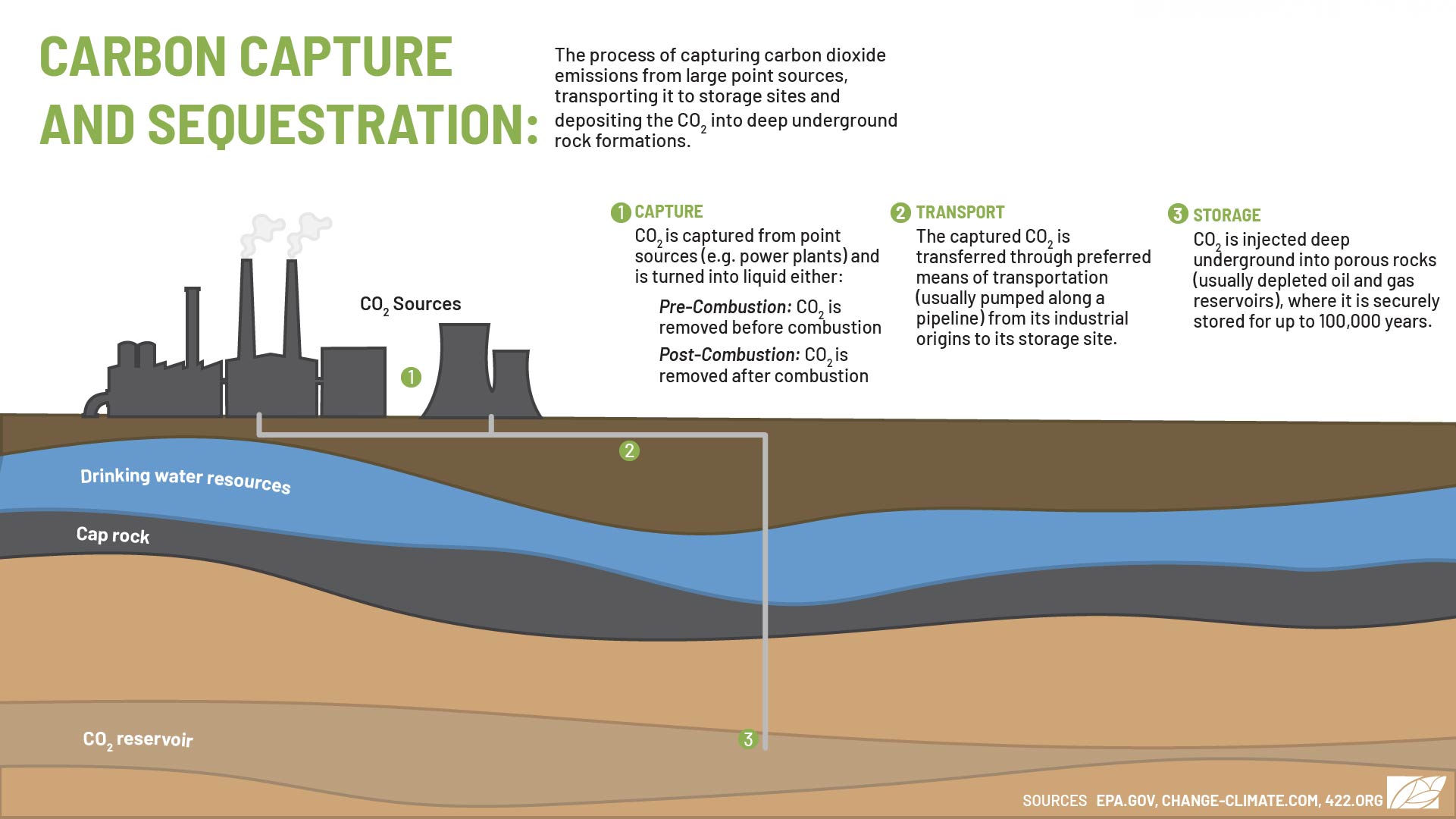

The bill expands a tax credit for companies that use carbon capture and sequestration, the process of trapping carbon dioxide emitted by a power plant or other polluting source, turning the carbon dioxide into a supercritical fluid and injecting it deep into the ground.

CCS projects could potentially capture a large majority of the carbon dioxide emitted by a power plant or other carbon dioxide source, but critics worry that funding CCS projects would prolong the life of fossil fuel-powered polluters instead of aiding the transition toward cleaner energy sources.

As of 2020, CCS projects worldwide are storing about 30 million tons of carbon dioxide every year, the equivalent of about 6.5 million cars. That is only a small portion of total greenhouse gas emissions. According to the U.S. Environmental Protection Agency, the U.S. alone emitted 5,222 million metric tons in 2020.

Government-funded carbon capture and sequestration projects have met with mixed success, according to the U.S. Government Accountability Office.

The GAO found that while the Department of Energy has invested $1.1 billion in CCS demonstration projects since 2009, only three of 11 demonstration projects selected for funding were ever built and entered operation.

The DOE selected eight CCS projects at coal-fired facilities, but only one was ever built after $684 million of funding.

The Petra Nova project at the W.A. Parish Electric Generating Station in Texas was built in 2017 with a $195 million DOE grant. The project was designed to capture and compress carbon dioxide captured at the plant. The gas would then be transported to an oil field where it was injected into the ground to displace oil for extraction, a process known as enhanced oil recovery. The remaining carbon dioxide would then be sequestered.

The project was shut down in 2020 due to high oil prices. During the three years of operation, the project had 367 days of outages and captured 3.8 million short tons of carbon dioxide, 17% fewer than expected.

The other projects selected by the DOE either withdrew due to economic viability issues or were terminated by the DOE.

At least one company in Indiana is aiming for a CCS project in the state, and recent state legislation could encourage more companies to participate.

The Wabash Valley Resources LLC ammonia and hydrogen plant in West Terre Haute is attempting to be the state's first successful CCS project and has received some DOE funding to establish the project. The Indiana General Assembly passed a law in 2019 allowing the company to establish a CCS pilot project, but the company has not succeeded in receiving a legally required Class VI underground injection control permit from the EPA to do so.

Indiana lawmakers passed a law earlier this year that allows more companies to establish CCS projects in the state. BP and CountryMark have expressed interest in establishing a CCS project in the state.

ELECTRIC VEHICLE TAX CREDIT

The proposed bill would extend a tax credit of up to $7,500 for the purchase of new electric vehicles for individuals making up to $150,000, or $300,000 for married couples.

It would also give a $4,000 tax credit for the purchase of used electric vehicles for individuals making up to $75,000, or $150,000 jointly.

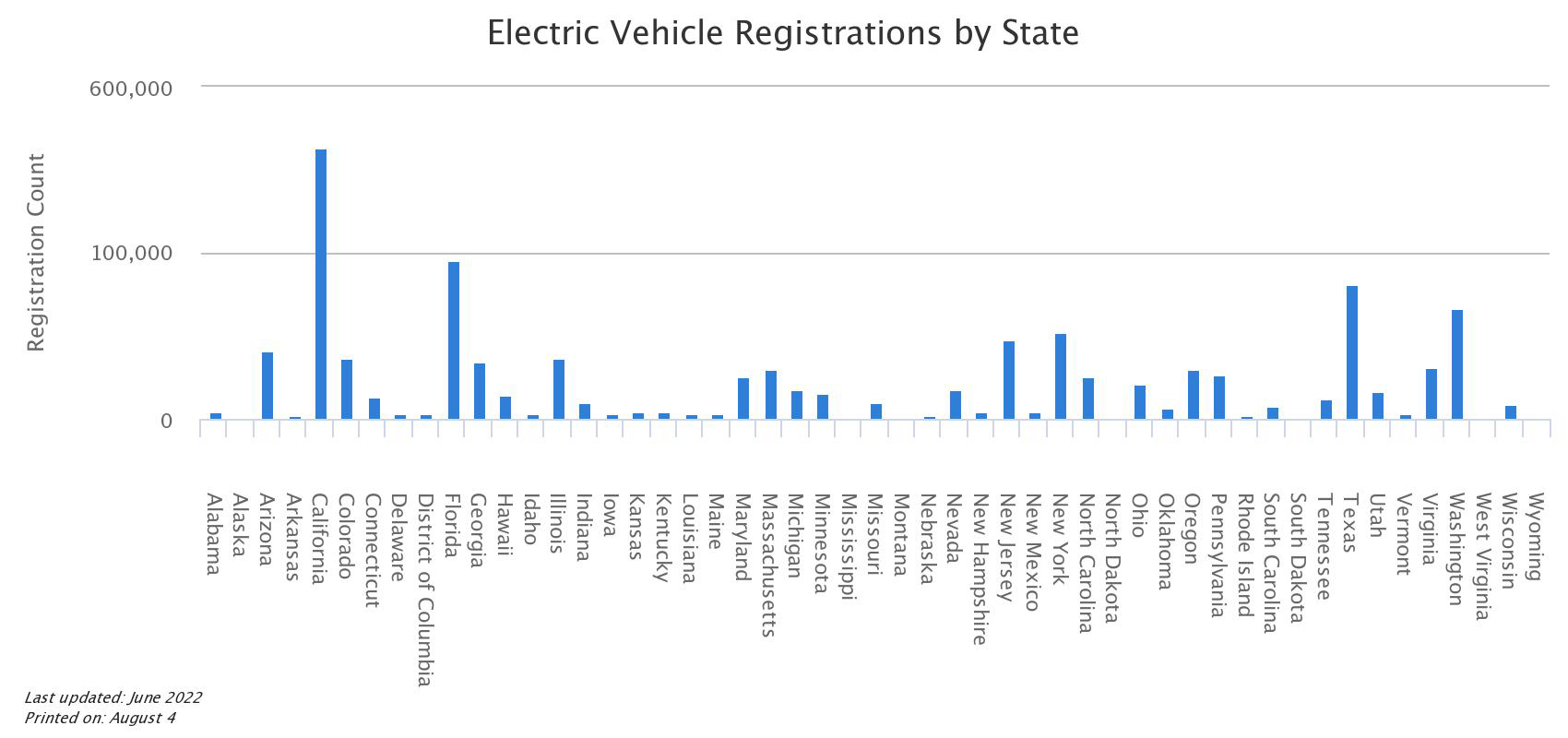

Transportation accounts for 27% of total greenhouse gas emissions in the U.S. Fossil fuel powered vehicles also emit toxic air pollutants that can cause or trigger a variety of cardiovascular or respiratory health problems in humans.

Transitioning to electric vehicles could have a significant impact on air quality and improve the health of Hoosiers. The Indiana Energy Association said that switching to electric vehicles could also save Hoosiers $500 million in reduced electric bills and $3.2 billion in reduced annual vehicle operating costs.

The state currently ranks 25th in the nation in electric vehicle registrations with 10,360, but Indiana is already gearing up improve the state’s electric vehicle capacity.

Gov. Eric Holcomb joined four other Midwestern governors in signing a memorandum of understanding to create a regional framework to accelerate the electrification of vehicles in the Midwest. The agreement sets Indiana, Illinois, Michigan, Minnesota and Wisconsin on a path to improve public and private investment in electric vehicles and electric vehicle infrastructure.

The state is also investing more than $100 million from the Infrastructure Investment and Jobs Act to build an electric vehicle charging network through the state. It's unclear when that would be completed.

ENERGY EFFICIENCY AND RESILIENCE

The bill invests about $4.5 billion in tax credits for home energy efficiency improvements, like windows, doors, heat pumps, electric water heaters and other improvements.

The Department of Housing and Urban Development is also set to receive more than $4 billion to fund direct loans for projects that improve energy or water efficiency, indoor air quality or sustainability, implement the use of low-emission technologies or address climate resilience for elderly, disabled or low-income residents.

LOW-INCOME AND RURAL COMMUNITY INVESTMENTS

The bill invests more than $60 billion in programs to clean up pollution in low-income and historically underserved areas.

The funding includes about $27 billion for a Greenhouse Gas Reduction Fund, $3 billion for environmental and climate justice block grants and $3 billion for Neighborhood Access and Equity Grants.

The bill also includes a $2 billion allocation for the Rural Energy for American Program, which provides loans and grants to agricultural producers and small businesses in rural areas for renewable energy systems and for energy efficiency upgrades, $20 billion to support climate-friendly agriculture practices and $500 million for biofuel infrastructure improvements.

The bill will also reinstate a tax on oil production and imports to fund Superfund cleanups.